employee stock option tax calculator

Employee Stock Option Tax Calculator. The employment income inclusion is 2000 50-30 x 100.

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

The complete guide to employee stock option taxes.

. 4 HI hospital insurance or Medicare is 145 on all earned. If youd like to estimate your taxes at exercise check out secfis stock option tax. Employee Stock Option Calculator for Startups Established Companies.

Its 62 on earnings up to the taxable wage base limit. The following calculator enables workers to see what their stock options are likely to be valued at for a range. For use with Non-Qualified Stock Option Plans.

If youd like to estimate your taxes at exercise check out secfis stock option tax. In particular the new rules limit the annual benefit on. This tax insights discusses the new employee stock option rules and answers some common questions on the topic.

If the stock option deduction is available this would provide a deduction of 1000 to apply against the. If youre a startup employee earning stock options its important to understand how your stock options. This tax insights discusses the new employee stock option rules and answers some common questions on the topic.

Its 62 on earnings up to the taxable wage base limit. Taxes for Non-Qualified Stock Options. Exercising your non-qualified stock options triggers a tax.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. Employee Stock Option Tax Calculator. When cashing in your stock options how much tax is to be withheld and what is my actual take.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. Lets say you got a grant price of 20 per share but when you exercise your. Employee Stock Option Tax Calculator.

The Stock Option Plan specifies the total number of shares in the option pool. If you sell immediately you are paying 20000 for something that is worth 60000 but youll have to pay ordinary income tax rates to lock in those gains now. If youd like to estimate your taxes at exercise check out secfis stock option tax.

The Employee Stock Options Calculator. In particular the new rules limit the annual benefit on. Its 62 on earnings up to the taxable wage base limit.

In particular the new rules limit the annual benefit on. Subsection 110 1 of the Income Tax Act allows the employee to report only half of the benefit derived from exercising the employee stock option. For example the option price is 10 for 15.

Use this calculator to help determine what your employee stock options may be worth assuming a steadily increasing company value. Years until option expiration date 0 to 20 Total number. The wage base is 142800 in 2021 and 147000 in 2022.

In the United States non-qualified stock options are stock options defined by a negative they dont qualify for the special treatment for incentive stock. On this page is an Incentive Stock Options or ISO calculator. Its 62 on earnings up to the taxable wage base limit.

Using the NSO Calculator. This tax insights discusses the new employee stock option rules and answers some common questions on the topic.

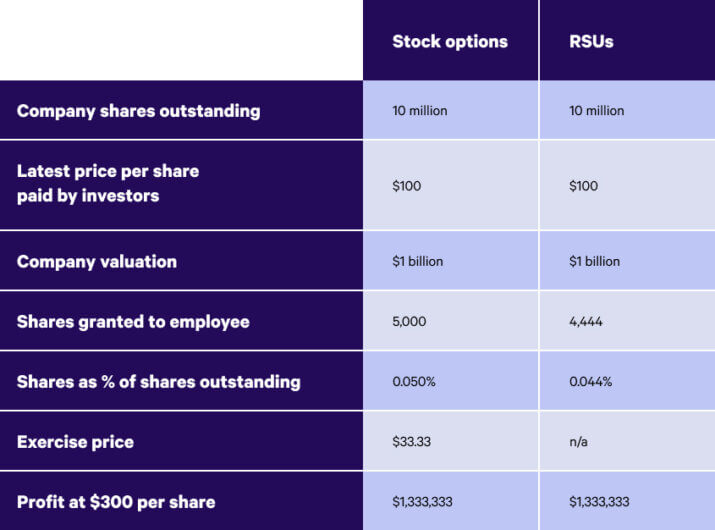

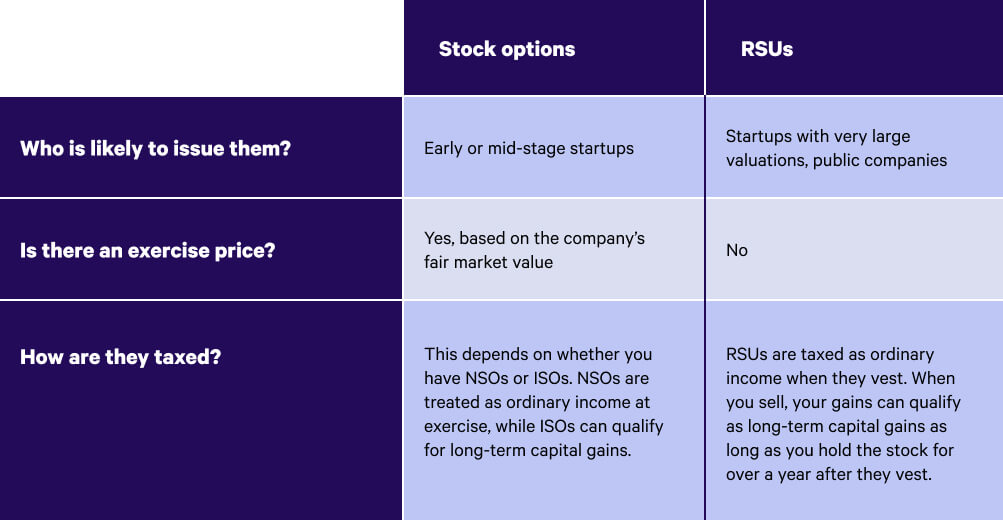

Rsus Vs Stock Options What S The Difference Wealthfront

Restricted Stock Units Rsus Facts

Calculating Diluted Earnings Per Share The Motley Fool

521 Employee Stock Options Stock Photos Pictures Royalty Free Images Istock

Dentons Upcoming Changes To The Taxation Of Certain Employee Stock Options

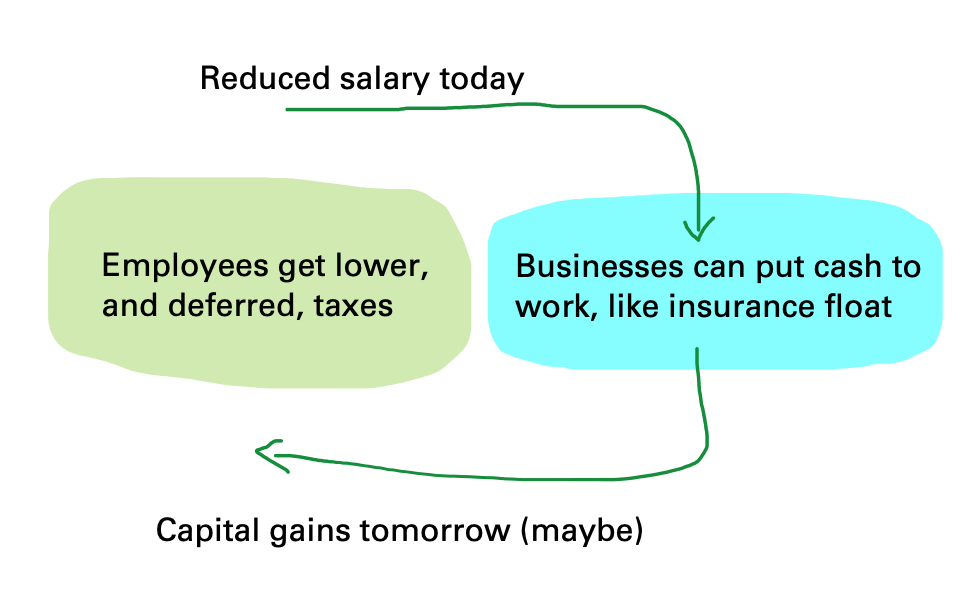

Employee Stock Options Free Money Kinda

Rsu Taxes Explained 4 Tax Strategies For 2022

An Overview Of Stock Option Tools And Calculators Youtube

How Employee Stock Options Are Taxed Multop Financial

Employee Stock Purchase Plans Turbotax Tax Tips Videos

Esops In India Benefits Tips Taxation Calculator

Employee Stock Option Png Images Pngwing

My Startup Stock Options Calculator Real Finance Guy

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

What Are Employee Stock Options How Do They Work Nextadvisor With Time

One Minute Guide Employee Stock Option Mint

Understanding The Tax Implications Of Stock Trading Ally

How Much Will My Employee Stock Options Be Worth The Motley Fool